China is NOT heading for collapse! Evaluating Peter Zeihan’s curious claims

Michael Fritzell makes a more nuanced case for China...

Supporters can listen to a narrated version of this article here.

Written by Michael Fritzell.

Geopolitics expert Peter Zeihan has a colourful personality. But during his recent appearance on the Joe Rogan show, he made several arguments that I found hard to swallow.

For example, Zeihan claimed that China will have around 10 years before its economy collapses. Weak demographics, rising labor costs, and increased isolation from the rest of the world all form part of the picture. However, Zeihan also discussed a potential invasion of Taiwan. In such a scenario, US sanctions would then hurt China to such an extent that they would cause de-industrialization and famine.

Further, Zeihan was critical of China’s handling of COVID-19. He pointed out that the population is now vulnerable due to its lack of natural immunity, widespread obesity, and the weak efficacy of the country’s homegrown vaccines.

As someone who has made a living analyzing Chinese equities and China’s economy for the past 15 years, I find Zeihan’s remarks to be, well, off the mark. They don’t paint a realistic picture of the country and where it’s going.

To start, I don’t believe that weak demographics will necessarily lead to a “collapse” of any kind. All that will happen is that economic growth will decelerate as the working-age population shrinks. But it’s going to be a gradual, drawn-out process. And on a per capita basis, the country may well become richer.

What Zeihan failed to mention is the fact that China’s retirement age is incredibly low from an international perspective – 60 for men and only 55 for women. I would wager that China’s retirement age is going to increase over the next few decades, partly counteracting the negative effect of a slow decline in the working-age population.

A dependency ratio is an age-population ratio of those typically not in the labor force and those typically in the labor force. It measures the pressure on the productive population. It’s true that China’s dependency ratio is rising. This means that the aggregate tax burden on the working-age population will go up. A slightly larger piece of the pie will need to go to pensions. But the Chinese tend to be resilient. Don’t forget the older generation lived through the tumultuous years of the cultural revolution in the 1960s and 70s. So to talk of an “economic collapse” is misleading – there’s nothing suggesting that the economy will reach any kind of tipping point within the next 10 years.

I agree with Zeihan that President Xi is undoing much of what caused the Chinese economic miracle in the first place. For example, since 2012, he has pushed for higher minimum wages and convinced multinationals to move their factories inland. Such efforts may have helped with wealth redistribution within China, but it has also caused Chinese manufacturing to become less competitive. That’s certainly an issue.

I also think that the country’s aggressive foreign policy under Xi has caused irreparable damage to its reputation. Skirmishes on the border with India, threats to Taiwan, the backlash against Korean products during the THAAD crisis, and hostile behavior in the East- and South China Seas have not won the country any friends.

And increased concerns about forced technology transfers, subsidies to state-owned enterprises, capital controls, and import tariffs have caused many multinationals to rethink their commitment to Chinese manufacturing. The introduction of so-called Communist Party committees in the Chinese subsidiaries of such multinationals has also raised eyebrows. The Chinese Communist Party is definitely starting to assert greater control over the economy.

Moreover, the ongoing shift away from Chinese manufacturing will take time. China’s infrastructure remains top-notch. Chinese workers are generally educated and hard-working. Various industry clusters have formed around the Yangtze- and Pearl River Deltas and those will be difficult to displace. The reality is that supply chains reliant on Chinese manufacturing have become well-oiled machines. Outsourcing production to smaller countries in Southeast Asia will be difficult, if not impossible. The shift will take decades, perhaps longer.

Based on what we know about Xi, he seems primarily concerned with power and influence. He spent years consolidating that power within the communist party and now he’s trying to help the party remain relevant in a new era. Read his speeches before he became General Secretary in 2012 and you’ll find that almost all of them were about maintaining party supremacy.

The big question is whether Xi will become less aggressive now that he became the leader for life after the Communist Party Congress in October 2022. Is it possible that his antagonistic behavior towards foreign nations was simply a way to shift blame for whatever discontent was building within the country? It wouldn’t be the first time that nationalism has been used to rally support for whatever the person at the top believes in.

However, I am not as confident as Peter Zeihan about Xi’s willingness to invade Taiwan. Both Japan and South Korea have now given implicit commitments to defend the island in the case of an invasion. The United States is unlikely to stay idle in such a scenario.

And if the People’s Liberation Army fails in its attempt to take control of the island, Xi’s head will be on the line. A failed invasion would be akin to political suicide. He must look at Putin’s failures in Ukraine and wonder whether a similar campaign over Taiwan would ultimately be worth it.

I want to offer an alternative future to Zeihan’s. It’s possible that China will not isolate itself from the rest of the world in the way that he thinks. It may simply reduce its reliance on US and European customers for its products and strengthen its bonds with other emerging markets such as Russia, Iran, and Pakistan.

In fact, China is already the biggest trading partner for most of the world outside of North America and Europe. The Chinese Communist Party clearly wants a world where its allies sell raw materials to China, while China sells manufactured goods back to them.

Moreover, the CCP’s bargaining power will probably increase with the widespread use of communication infrastructure built by companies such as Huawei and ZTE. If any data is stored within mainland China, that data must be presented to the government upon request. That’s stated clearly in China’s cyber security law. Countries relying on Chinese communication infrastructure are, therefore, likely to be political allies of China.

Countries that have banned Huawei telecom infrastructure. Source: CFR

Further, placing People’s Liberation Army officers in those countries will ensure stable trade, with less reliance on US Navy support. China’s discussions with its new allies are now done under the so-called Global Security Initiative framework set up in 2022.

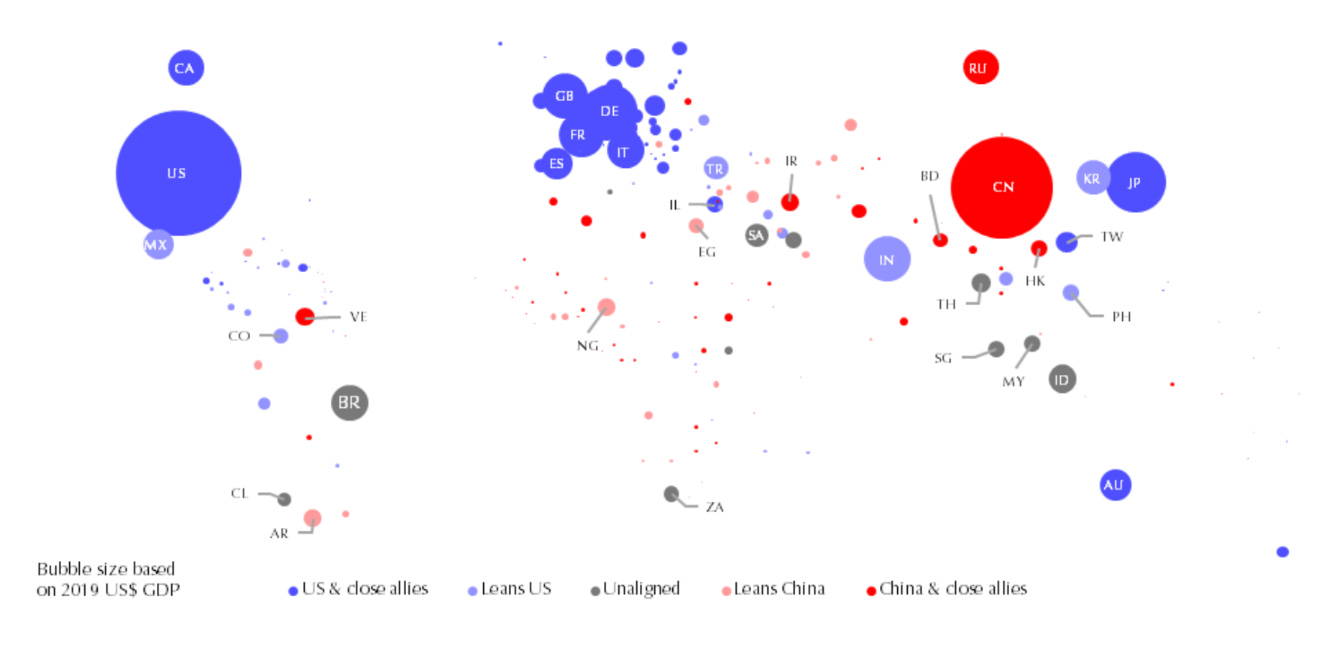

Now that the world is being divided into two camps, we could see a return to a cold war, with an iron curtain rising between North America/Europe and the rest of the world. American and European manufacturing will have to be reshored. The majority of world GDP will remain in the “Western” camp, while the majority of the population will belong to countries allied with China.

Current global alignment towards the US and China. Source: Capital Economics

Whether China’s economy can thrive in this new world order is unclear. Recent crackdowns on the tech, property and tuition sectors are worrisome. Communist Party committees have been introduced in many private enterprises. However, China still enjoys a current account surplus and does not rely on external debt. Again, this makes it odd to speak of an imminent collapse when there is no obvious catalyst for such a collapse to take place.

Zeihan didn’t mention China’s housing market, but that’s unlikely to be a problem either. We all know that there has been excess construction of housing in China. Home prices are now high in most tier-1 cities.

But construction activity has already come off sharply. In my view, that’s a positive development. The excess construction problem has essentially been dealt with. While it may not be positive that private developers are going bankrupt, employing millions of workers to build housing nobody needs is hardly productive either.

When it comes to COVID-19, I’m not as bearish as Zeihan. The Omicron variant leads to mild symptoms, even for individuals who haven’t been vaccinated. Yes, Sinovac vaccines are less effective than western mRNA vaccines, but the differences aren’t as large as commonly made out to be.

Further, China’s obesity rates aren’t nearly as high as those in the United States. Zeihan’s bizarre claim about obesity makes me wonder whether he has ever set a foot in the country! And despite its weak healthcare system and low GDP per capita, China’s life expectancy is actually higher than that in the United States. That’s a remarkable achievement.

Now that COVID-19 is spreading fast in China, herd immunity will be building as well. Once the population has become exposed, it will be easier to remove restrictions and look forward to a return to normal.

The reality is that Chinese households have been saving money for the past years. They’re in much better shape than before. Now that most COVID-19 restrictions have gone away and the borders have reopened, expect a forceful recovery in China’s consumer demand. This recovery could take place as soon as the first quarter of 2023.

Longer-term, it does look like the world is becoming more divided. China’s President Xi is a socialist and seeks to reassert control over the nation’s private enterprises. I believe the economy will slowly become less dynamic and relevant as supply chains move out of the country.

Given this nuanced picture, Zeihan’s talk of an imminent collapse seems misplaced. Especially now that China’s economy is finally regaining its footing after three years of COVID chaos. Once the economic recovery picks up throughout 2023, Peter Zeihan will probably look rather foolish.

Michael Fritzell is a full-time writer focusing on stocks in Asia. He is the author of Asian Century Stocks, a Substack focusing on Asian equities.

You made it to the end of the article and now you’re reading this. Perfect. That means I can ask you to subscribe and also consider a quid pro quo. Here’s how it works: you give us the equivalent of a couple of coffees a month and we’ll continue to pump content into your brain. And we’ll even throw in some exclusive benefits, like narrated articles and access to the special questions we ask guests, plus early access to our podcasts and high-production films. Join/upgrade today!

If you enjoyed this, you might want to check out Michael’s other article for ISF!